The Best Investment Books Ideas

Wiki Article

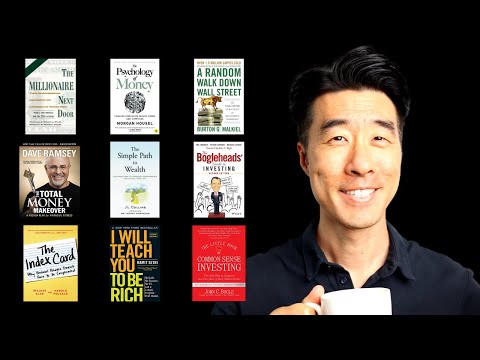

The most beneficial Investment decision Guides

Get This Report about Best Investment Books

Interested in getting to be a greater investor? There are various textbooks which can help. Prosperous investors browse extensively to develop their skills and keep abreast of emerging strategies for financial investment.

Interested in getting to be a greater investor? There are various textbooks which can help. Prosperous investors browse extensively to develop their skills and keep abreast of emerging strategies for financial investment.Benjamin Graham's The Clever Investor is surely an indispensable guidebook for almost any investor. It handles almost everything from essential investing strategies and risk mitigation methods, to benefit investing strategies and tactics.

one. The Tiny Ebook of Typical Sense Investing by Peter Lynch

Composed in 1949, this typical get the job done advocates the worth of investing with a margin of basic safety and preferring undervalued shares. A must-examine for any person keen on investing, particularly Those people wanting further than index resources to detect specific substantial-price long-phrase investments. Also, it handles diversification principles and also how in order to avoid getting mislead by industry fluctuations or other investor traps.

This e book supplies an in-depth guidebook regarding how to turn out to be An effective trader, outlining every one of the principles each and every trader really should know. Matters mentioned while in the ebook vary from sector psychology and paper trading tactics, steering clear of common pitfalls for example overtrading or speculation and more - earning this guide crucial reading through for critical traders who would like to assure they possess an in-depth knowledge of essential investing concepts.

Bogle wrote this comprehensive ebook in 1999 to drop mild within the hidden service fees that exist inside mutual resources and why most investors would profit much more from purchasing lower-payment index funds. His information of saving for rainy working day money whilst not inserting your eggs into a person basket as well as buying inexpensive index funds remains legitimate today as it had been back then.

Robert Kiyosaki has prolonged championed the necessity of diversifying cash flow streams by means of real estate and dividend investments, particularly real-estate and dividends. Even though Prosperous Father Weak Father could slide much more into own finance than private development, Abundant Dad Lousy Dad stays an informative examine for anybody wishing to higher understand compound desire and how to make their dollars perform for them rather than in opposition to them.

For something far more up to date, JL Collins' 2019 book can offer some much-essential point of view. Intended to deal with the desires of monetary independence/retire early communities (Hearth), it concentrates on achieving money independence as a result of frugal living, low price index investing as well as 4% rule - in addition to methods to lessen scholar financial loans, spend money on ESG belongings and make use of online investment assets.

two. The Minimal E-book of Inventory Market Investing by Benjamin Graham

Interested in investing but Doubtful tips on how to commence? This reserve presents practical steering published specifically with youthful investors in your mind, from substantial university student loan financial debt and aligning investments with personalized values, to ESG investing and on line fiscal methods.

This most effective expenditure guide demonstrates you how to establish undervalued shares and make a portfolio that could offer a steady supply of cash flow. Employing an analogy from grocery buying, this greatest ebook discusses why it is much more prudent never to focus on pricey, well-marketed goods but in its place consider small-priced, disregarded ones at profits rates. Furthermore, diversification, margin of basic safety, and prioritizing value in excess of advancement are all discussed extensively all through.

A basic in its subject, this book explores the fundamentals of worth investing and the way to determine options. Drawing on his financial investment business Gotham Cash which averaged an annual return of 40 % through twenty years. He emphasizes averting fads even though paying for undervalued organizations with robust earnings prospective customers and disregarding limited-expression market fluctuations as crucial concepts of productive investing.

The Best Guide To Best Investment Books

This best financial commitment book's author presents assistance for new investors to steer clear of the faults most novices make and maximize the return on their own dollars. With action-by-phase Guidelines on creating a portfolio built to steadily improve as time passes and the author highlighting why index funds deliver essentially the most effective indicates of expense, it teaches viewers read more how to take care of their system despite current market fluctuations.

This best financial commitment book's author presents assistance for new investors to steer clear of the faults most novices make and maximize the return on their own dollars. With action-by-phase Guidelines on creating a portfolio built to steadily improve as time passes and the author highlighting why index funds deliver essentially the most effective indicates of expense, it teaches viewers read more how to take care of their system despite current market fluctuations.Examine This Report about Best Investment Books

While to start with revealed in 1923, this ebook stays an invaluable guidebook for any person thinking about taking care of their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and missing thousands and thousands around his life span - while highlighting the importance of chance principle as Element of determination-generating procedures.

While to start with revealed in 1923, this ebook stays an invaluable guidebook for any person thinking about taking care of their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and missing thousands and thousands around his life span - while highlighting the importance of chance principle as Element of determination-generating procedures.If you are seeking to improve your investing abilities, you will find several excellent books around for you to choose. But with best investment books confined hrs in every day and confined obtainable reading substance, prioritizing only All those insights which supply essentially the most price may be tough - which is why the Blinkist application offers this sort of easy access. By gathering key insights from nonfiction guides into bite-sized explainers.

three. The Small Guide of Price Investing by Robert Kiyosaki

This book covers purchasing enterprises by having an financial moat - or aggressive edge - which include an economic moat. The creator describes what an economic moat is and offers samples of a number of the most renowned corporations with 1. In addition, this ebook information how to determine a firm's worth and buy stocks In keeping with price tag-earnings ratio - ideal for newbie traders or everyone wanting to master the fundamentals of investing.

This doorstop investment decision ebook is each common and comprehensive. It covers most of the very best tactics of investing, such as beginning young, diversifying commonly and not spending significant broker fees. Penned in an engaging "kick up your butt" model which may either endear it to readers or turn you off totally; whilst covering lots of frequent pieces of recommendation (spend early when Other folks are greedy; be wary when Other folks get more info turn out to be overexuberant), this textual content also suggests an indexing strategy which seriously emphasizes bonds in comparison with lots of identical methods.

This ebook presents an insightful strategy for inventory finding. The writer describes how to select winning shares by classifying them into six distinct categories - gradual growers, stalwarts, rapidly growers, cyclical stocks, turnarounds and asset performs. By adhering to this clear-cut technique you boost your odds of beating the market.

Peter Lynch is amongst the globe's Leading fund administrators, acquiring run Fidelity's Magellan Fund for thirteen a long time with a median return that conquer the S&P Index every year. Released in 2000, his e book highlights Lynch's philosophy for selecting stocks for unique traders in an accessible method that stands in stark distinction to Wall Street's arrogant and extremely specialized strategy.

Warren Buffett, on the list of richest Gentlemen on this planet, has an uncanny capacity to Consider logically. This reserve, initially created as letters to his daughter, includes sensible and intelligent suggestions on earning the inventory market give you the results you want - with its most famed idea remaining buying undervalued assets for more than their intrinsic worth - delivering newcomers to investing with a fantastic foundation in investing and professional kinds with precious suggestions to really make it lucrative. This is certainly one of the better publications to Keep reading investing.

4. The Very little Reserve of Inventory Marketplace Buying and selling by Mathew R. Kratter

If you wish to acquire stock current market investing encounter and develop your personal portfolio, this ebook provides an ideal spot to start. It clarifies how to choose stocks with robust advancement possible even though teaching you about examining providers - and aiding novices keep away from common glitches they frequently make. Furthermore, its crystal clear and easy language make for a nice reading through working experience.

Benjamin Graham is recognized as the father of price investing, an approach focused on getting excellent shares at very low price ranges. He wrote two textbooks on investing; Stability Evaluation is his signature operate describing his conservative, value-oriented system - it's even been recommended by best buyers such as Monthly bill Ackman and John Griffin!